Marginal tax rate calculator

Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Total Tax 1098174 Income Tax 765749 EI Premiums 790 CPP Contribution 253425 After-Tax Income 3901826 Average Tax Rate 1531 Marginal Tax Rate 2965.

Pdf The Calculation Of Marginal Effective Tax Rates

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

. Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results. Your income puts you in the 10 tax bracket. Calculate your combined federal and provincial tax bill in each province and territory.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. This is 0 of your total income of 0.

Your Federal taxes are estimated at 0. 0 would also be your average tax rate. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Marginal Tax Rate Calculator. This calculator helps you estimate. Personal tax calculator.

0 would also be your average tax rate. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax.

How much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be used. At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0.

Marginal Tax Rate Calculator for 2022 indicates. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. This is 0 of your total income of 0.

Ad Partner with Aprio to claim valuable RD tax credits with confidence. Calculate the tax savings. These calculations are approximate and include.

Your income puts you in the 10 tax bracket. Your income puts you in the 10 tax bracket. At higher incomes many.

Your Federal taxes are estimated at 0. This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. At higher incomes many deductions and many credits are phased.

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0. This calculator shows marginal rates for 2020.

This is 0 of your total income of 0. Discover Helpful Information And Resources On Taxes From AARP. Your income puts you in the 10 tax bracket.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax rate. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax rate.

Tax Rate Calculator Hot Sale 59 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Formula Excel University

Marginal Tax Rate Formula Definition Investinganswers

Tax Rate Calculator Hot Sale 59 Off Www Ingeniovirtual Com

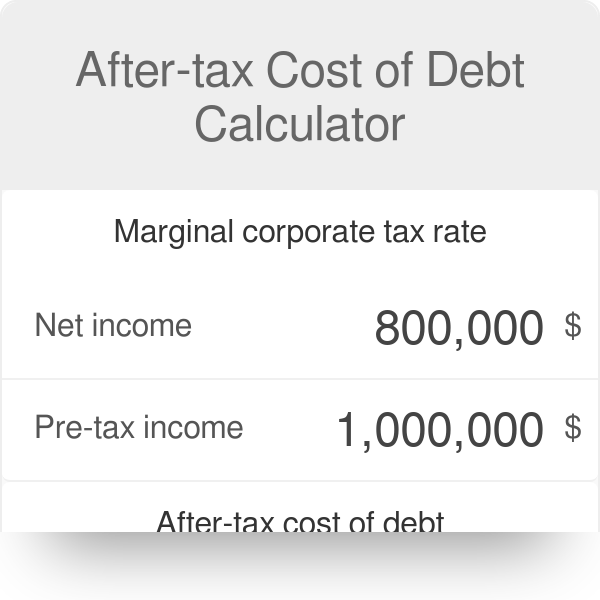

Cost Of Debt Kd Formula And Calculator Excel Template

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

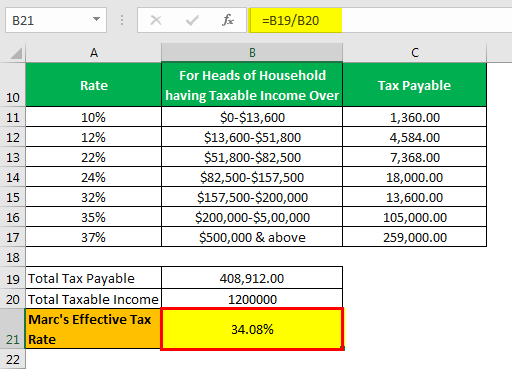

Effective Tax Rate Formula Calculator Excel Template

Income Tax Formula Excel University

Reinvestment Rate Formula And Example Calculator Excel Template

After Tax Cost Of Debt Calculator Required Return Of Debt

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

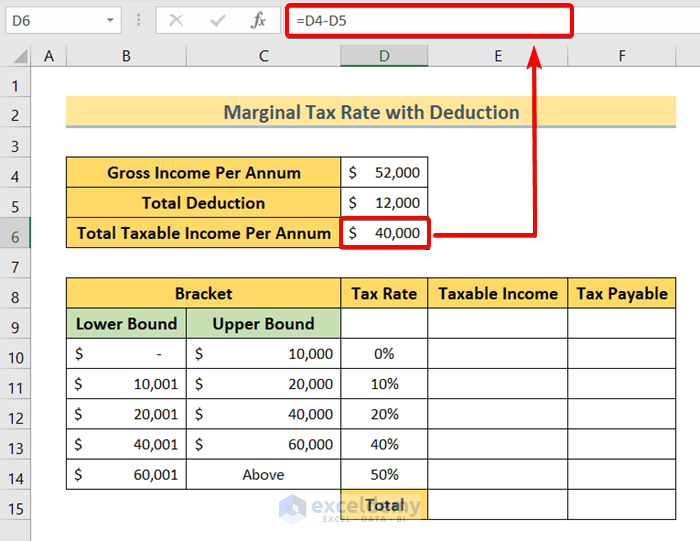

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways Exceldemy

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Marginal And Average Tax Rates Example Calculation Youtube